Budgeting is one of those things everyone knows they should do, yet many people avoid because it feels overwhelming or restrictive. The truth is, you don’t need complicated spreadsheets or hours of number-crunching to get control of your money. What you really need are a few practical strategies that fit into your everyday life.

In this guide, you’ll find 12 budgeting hacks that actually work. These aren’t extreme tips that force you to cut out everything fun. Instead, they’re realistic, flexible, and designed to help you spend smarter, save more, and feel in control of your finances.

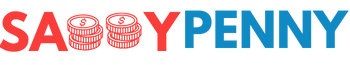

1. Follow the 50/30/20 Budget Rule

If you’re new to budgeting, start simple. The 50/30/20 budget rule is one of the easiest frameworks to follow. Here’s how it works:

- 50% of your income goes to Needs – housing, groceries, utilities, transportation, and insurance.

- 30% goes to Wants – dining out, hobbies, subscriptions, shopping, and vacations.

- 20% goes to Savings & Debt Repayment – emergency fund, retirement accounts, investments, and paying off loans faster.

This structure prevents you from overspending in one area while ensuring you’re still saving consistently.

Pro Tip: If your “needs” are taking up more than 50% of your income, look for ways to downsize fixed costs (such as refinancing, moving to a cheaper apartment, or cutting utility bills).

2. Automate Your Savings

Saving is tough when you rely on willpower. The solution? Make it automatic. Set up an automatic transfer from your checking account to your savings account on payday. Treat it like a bill you can’t skip.

For example, if you automatically move $100 each payday, that’s $2,400 a year without even thinking about it.

Pro Tip: Open a separate high-yield savings account for your emergency fund so the money grows faster and is harder to dip into for everyday spending.

3. Track Your Spending for 30 Days

Before you can fix your spending, you need to know where your money is going. Spend one month tracking every single purchase. Use a free budgeting app like Mint or YNAB, or just write things down in a notebook.

Most people are shocked when they see the total amount spent on coffee runs, takeout, or random Amazon orders. Awareness is the first step to improvement.

Pro Tip: After tracking for 30 days, highlight 2–3 categories where you overspend and create specific limits for them in your budget.

4. Use Cash Envelopes for Problem Areas

If you struggle with overspending in certain categories—like eating out, groceries, or shopping—the cash envelope method is a game-changer. Here’s how it works:

- Withdraw the amount you’ve budgeted for that category.

- Place it in a labeled envelope (for example: “Dining Out – $200”).

- Spend only from that envelope. Once it’s empty, you stop.

This method forces discipline and helps you stick to your budget without relying on guesswork.

Pro Tip: If carrying cash feels inconvenient, use a prepaid debit card just for that category—it works like a digital envelope.

5. Cancel Subscriptions You Don’t Use

Streaming platforms, fitness apps, premium memberships, and unused software quietly eat into your budget. Many people forget they even signed up for some of them.

Review your bank statements for recurring charges. Ask yourself: “Do I use this enough to justify the cost?” If not, cancel it. Cutting just two $10 subscriptions saves $240 a year.

Pro Tip: Use an app like Truebill or Rocket Money that identifies and cancels unwanted subscriptions for you.

6. Meal Plan and Cook at Home

Food is one of the biggest expenses for families. A little planning can make a huge difference.

By creating a weekly meal plan, shopping with a grocery list, and prepping food ahead, you reduce impulse buys and food waste. Even swapping two restaurant meals a week for home-cooked meals could save $100 or more per month.

Pro Tip: Cook double portions of dinners and freeze leftovers for busy nights—this prevents last-minute takeout orders.

7. Apply the 24-Hour Rule Before Buying

Impulse purchases are budget killers. The 24-hour rule helps you avoid regret. Whenever you want to buy something that isn’t essential, wait at least 24 hours before purchasing.

Often, the urge to buy fades, and you realize you don’t really need it. If you still want it after 24 hours, it probably has more value to you.

Pro Tip: Keep a “Want List.” Write down non-essential items you’re tempted to buy and revisit the list monthly. Many things will drop off, saving you money.

8. Try a No-Spend Challenge

A no-spend challenge means avoiding unnecessary purchases for a set period—like a weekend, a week, or even a full month. You still cover essentials, but you avoid extras like shopping, takeout, or entertainment.

This exercise reveals your spending habits and resets your perspective on needs vs. wants.

Pro Tip: Start small with a 7-day challenge, then try a 30-day no-spend month once or twice a year to give your savings a boost.

9. Pay Yourself First

Most people save whatever is left after spending—which often means nothing. Flip the script and pay yourself first. As soon as you get paid, move money into savings and debt repayment before spending on anything else.

Even if you can only save 5–10% at first, building the habit matters more than the amount. Over time, increase the percentage.

Pro Tip: Automate this process so you never even see the money—it goes straight into savings or investments.

10. Use Round-Up Savings Apps

Round-up apps automatically round up your purchases to the nearest dollar and transfer the difference into savings or investments. For example, if you spend $3.60 on coffee, the app rounds it up to $4 and saves the extra $0.40.

Apps like Acorns, Qapital, or Chime make saving effortless and fun.

Pro Tip: Combine round-ups with automatic transfers for faster savings growth.

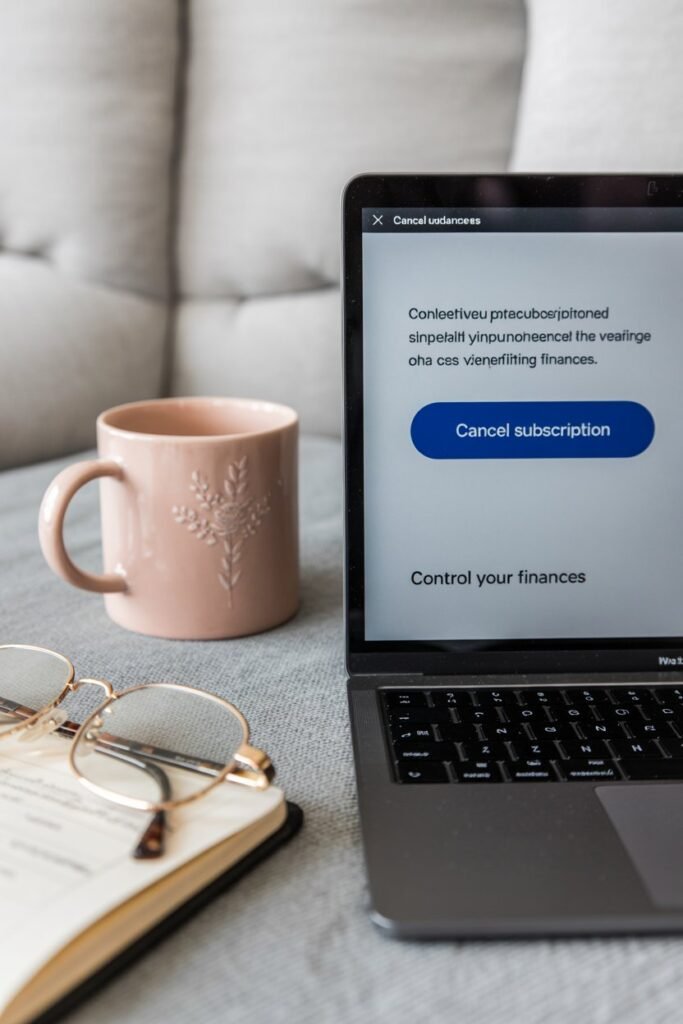

11. Budget with Percentages, Not Just Numbers

Instead of setting strict dollar amounts for every category, try budgeting by percentages. For example:

- 20% for housing,

- 10% for transportation,

- 15% for groceries,

- 20% for savings, and so on.

This method adjusts naturally as your income changes and makes budgeting feel more flexible.

Pro Tip: Use percentage-based budgeting if you have variable income (freelancers, gig workers, or side hustlers).

12. Review and Adjust Monthly

A budget is not set in stone—it should change as your life changes. At the end of each month, review your spending, see where you went over or under, and adjust your budget for the next month.

This reflection helps you stay accountable and continuously improve your money management.

Pro Tip: Schedule a “money date” once a month—30 minutes to review your budget, check goals, and plan ahead. Treat it like a routine, not a chore.

Final Thoughts

Budgeting doesn’t mean giving up everything you enjoy. It’s about making intentional choices with your money so you can reach your goals faster. These 12 budgeting hacks prove that even small changes—like automating savings, meal planning, or following the 50/30/20 rule—can lead to big results over time.

The key is consistency. Start with two or three hacks from this list, stick with them for a month, and gradually add more. Over time, you’ll find that managing your money feels less stressful and much more rewarding.

Smart budgeting isn’t about restriction—it’s about freedom. The more control you have over your money, the more freedom you’ll have to build the life you really want.